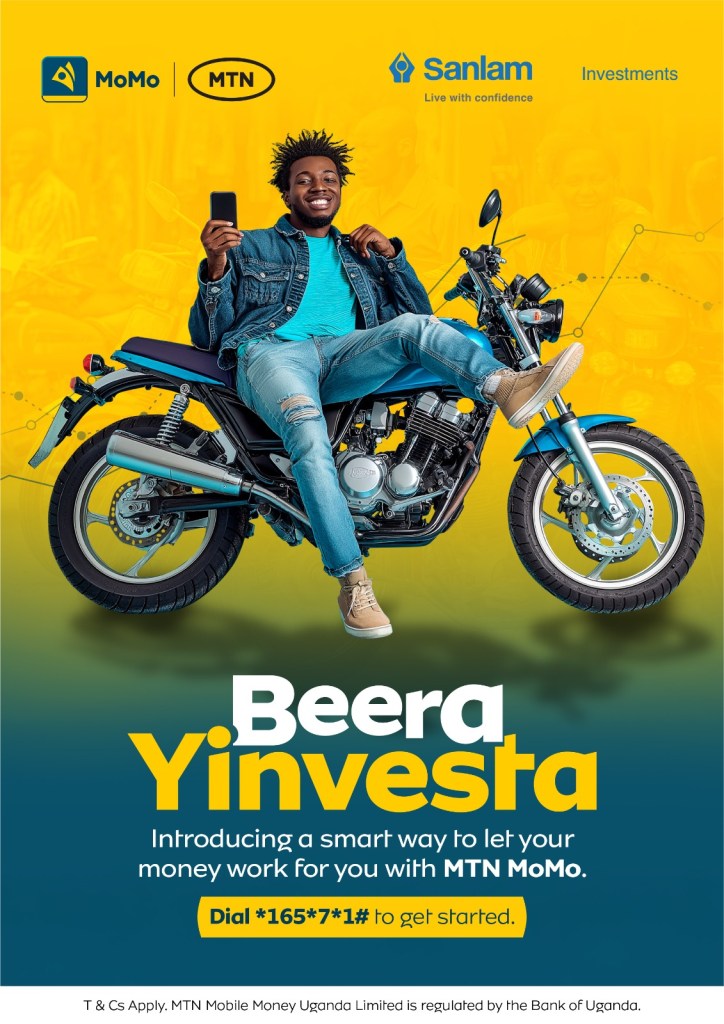

- MTN Mobile Money (U) Limited (MTN MoMo) and Sanlam Investments East Africa Limited have launched Yinvesta, a unit trust investment product that makes investing easy, accessible, and flexible for all Ugandans.

- Yinvesta allows customers to start investing with as little as UGX 1,000, offering daily interest earnings, easy withdrawals, and full transparency through MTN MoMo channels.

- The product is licensed by the Capital Markets Authority of Uganda and is structured to pool funds for investment in a diversified portfolio of financial instruments including treasury bills, bonds, and bank deposits. Its primary objective is to preserve capital while delivering a competitive return.

- Ugandans can start investing today by dialing *165*7*1# and select option 1, making wealth creation more accessible than ever.

MTN Mobile Money (U) Limited (MTN MoMo) has partnered with Sanlam Investments East Africa Limited to launch Yinvesta, a revolutionary unit trust investment product designed to make investing easy, accessible, and flexible for all Ugandans. The launch event was held at MTH Uganda Head Quarters , bringing together industry leaders, financial experts, and young entrepreneurs eager to embrace smart investment solutions.

Yinvesta allows customers to start investing with as little as UGX 1,000, offering daily interest earnings, easy withdrawals, and full transparency through MTN MoMo channels. This initiative reinforces MTN MoMo’s commitment to providing innovative financial solutions that empower Ugandans to take control of their financial future.

Speaking at the launch, Jemima Kariuki, Chief Product Officer at MTN MoMo, emphasized the significance of Yinvesta in democratizing investment opportunities.

“At MTN MoMo, we believe that financial empowerment should be accessible to everyone. Yinvesta simplifies investing, making it possible for Ugandans to grow their wealth effortlessly. With just UGX 1,000, anyone can start their journey toward financial independence. Together, our moves are unstoppable,” said Kariuki.

Yinvesta operates as a unit trust, pooling investments from multiple individuals into a professionally managed fund ensuring stability, reduced risk and offer a competitive return to the investors. The product is licensed by the Capital Markets Authority of Uganda under the Collective Investments Schemes Act of 2003.

Jonathan Stichbury, Chief Executive Officer at Sanlam Investments East Africa Limited, highlighted the importance of accessible investment options in the current economic landscape.

“At Sanlam, we empower generations to be financially confident, secure, and prosperous. Technology has transformed business operations and the investment industry is no exception. With the launch of Yinvesta, we are revolutionizing the way Ugandans invest. This user-friendly mobile phone platform empowers individuals to start investing with as little as UGX 1,000, As Yinvesta offers daily interest on earnings but also enables instant withdrawals, making investing both simple and flexible for everyone.” We are excited about the potential of this partnership, which will have a profound impact in the financial landscape of Uganda. By combining over 25 years’ experience in the region and innovative spirit, we will create a brighter future for our clients and the country.’’ Stichbury stated.

The launch event featured a live product demo, a panel discussion on financial literacy, and exclusive investment insights from industry experts. Customers can start investing today by dialing *165*7*1#on their mobile phones or using the MTN MoMo app.

Join thousands of Ugandans taking charge of their financial future with Yinvesta. Start investing with just UGX 1,000 and watch your money grow. Dial *165*6# or use the MTN MoMo app today!

MTN Mobile Money Uganda Limited (MTN MoMo) has become aware of an article attributed to The Kampala Journal containing false allegations about deductions on all its subscriber Mobile Money wallets of at least 100/=. The article further alleges that these deductions were made to fund political campaigns and in response to the recent “Trump USAID ban.”

MTN MoMo categorically refutes these baseless allegations and clarifies that the deductions in question were made to recover transaction fees that were inadvertently omitted due to a temporary system glitch which occurred on the 8th day of February 2025. This technical issue caused payment fees for certain transactions not to be charged in real time.

Upon identifying this system error, MTN MoMo initiated the recovery of the outstanding transaction fees on the 13th of February 2025 to ensure proper reconciliation. Our customers were notified by SMS and an official communication issued earlier today.

We wish to assure our esteemed subscribers, stakeholders, and the general public that:

- The MTN Mobile Money platform is safe and secure: We adhere to international standards of security and integrity in all our operations.

- Regulatory Compliance: MTN MoMo operates under strict compliance with the laws of Uganda and maintains the highest governance standards.

- Engagement with Regulators: The Bank of Uganda has been duly notified about the system glitch that caused the delay in charging transaction fees.

MTN Mobile Money Uganda Limited remains a responsible corporate entity committed to providing reliable services and maintaining the trust of its customers. We appreciate your continued support and understanding as we resolve this matter.

—– END—–

For more information, please contact:

MTN Uganda Press Office: mediadesk.ug@mtn.com

MTN Mobile Money agents in Mbarara district were very happy over the weekend as MTN Mobile Money Uganda Limited rewarded the best performing agents in the district.

In the MTN MoMo Nyabo Waaka promotion that was launched by the fintech last month, over 5,000 MTN Mobile Money agents countrywide, who excel in their business performance will get mobile money over the period of the promotion.

Last week, MTN rewarded the best performing mobile money agents in Mbarara district for their resilience and effort to remain operational despite the two-year lockdown.

Rogers Karamuzi, an MTN mobile money agent along High Street in Mbarara was very happy to be one of the winners in this promotion.

Karamuzi took home UGX100,000 handed over by MTN via mobile money for his business excellence during the promotion. Overjoyed at the news of his win, Karamuzi committed to encourage even more of his customers to deposit from his business.

A few metres away was Shillah Orikiriza, another exceptional mobile money agent operating in Mbarara’s beautiful town. She sits on a stool with a small table for her belongings. Orikiriza wakes up early in the morning to target the early bird customers but also works extra hours when the traffic overflows in the evening.

She has built experience working for mobile money over the years and also has a customer base that keeps supporting her business.

Like Karamuzi, Orikiriza won UGX100,000 from MTN MoMo for her exceptional business acumen. Speaking to media personality and also a presenter of the 4th edition of MoMo Nyabo promotion Haffi Powers, Orikiriza was extremely grateful to MTN for appreciating its stakeholders.

During this promotion, the best performing MTN MoMo Agents in all districts of Uganda will win mobile money and other prizes. Every week for 8 weeks, 675 agents will receive UGX100,000.

In May, MTN introduced the MoMo Nyabo Waaka Promotion wherein 24 Toyota Succeed cars will be given away, and Mobile Money worth 1,600,000,000 to 16,000 lucky winners over the 8 weeks of the promotion.

Customers simply need to deposit UGX20,000 on their MTN mobile wallet and stand a chance to win a car. The more you deposit, the higher your chances of winning.

Customers are encouraged to ensure that their MTN mobile money simcards are registered fully in the same names reflected on their National Identifications. This can be done at any service center country wide.

As the MoMo Nyabo promotion continues, Ugandans are cautioned to be aware of conmen, emphasizing that all winners are to be contacted only by 0312120000, which is the official calling number from MTN.

- MTN MoMo has launched the fourth edition of the popular MoMoNyabo promotion under the theme MoMoNyabo Waaka

- MTN Uganda will be giving away 24 Toyota Succeed cars, and Mobile Money worth 1,600,000,000 to 16,000 lucky winners over the 8 weeks of the promotion

- MTN customers simply need to deposit at least Ush. 20,000/- on their MTN MoMo account to stand a chance of winning during the promo. The more deposits a customer makes, the higher their chances of winning.

- The best performing MTN MoMo Agents in all districts of Uganda will also win mobile money and other prizes during the promotion.

- Customers are advised to beware of conmen and stay on alert. All the Winners shall be contacted only by 0312120000.

MTN Mobile Money Uganda has today launched the 4th edition of the highly rewarding MoMoNyabo promotion under the theme MoMoNyabo Waaka, with prizes worth over 2.5 billion shillings to be won by over 16,000 MTN MoMo customers and agents across the country.

Customers will only need to deposit Ush. 20,000/- or more on their MTN Mobile Money accounts to stand a chance to win prizes including 24 brand new Toyota Succeed cars, and mobile money worth Ush 1,600,000,000/-.

Three lucky customers will win Toyota’s every week while 2,000 will each win Ush. 100,000/- mobile money every week for 8 weeks. Over 5,000 MTN Mobile Money agents countrywide, who excel in their business performance will get mobile money over the period of the promotion.

Over and above rewarding the lucky customers who will be drawn in the promotion, this MoMo promotion celebrates the resilience of our customers, who despite the two difficult years of lockdown continue to hustle to make it.

Speaking at the launch of the MoMoNyabo Waaka promotion, Richard Yego, the MTN Mobile Money Managing Director said that “We are happy to engage and excite our MTN MoMo customers again now that the economy is fully reopened. Through this campaign, MTN MoMo will be giving away cars and cash (through MTN MoMo) to active MoMo customers who will deposit Money on their MoMo accounts,” Yego said.

Mr. Yego explained that all a customers should do to participate in the promotion and stand a chance of winning, is deposit at least Ush. 20,000/- on their MTN MoMo accounts. They will then enter the draws and stand a chance to win the cars and cash prizes on offer.

Yego further added that the more deposits customers make, the higher their chances of winning. He also clarified that after depositing cash to enter the draw, customers can choose how to use their money. “You can use it for shopping with MTN MoMoPay, paying bills like Yaka or water, buy airtime, voice and data bundles, sending money at zero fees using the MTN MoMo app or simply keep it safe on your phone,” Yego said.

Depositing money on MTN MoMo is free and MTN MoMo customers can use MTN MoMo to send and receive money, top MTN airtime, pay utility bills, MTN postpaid services, school fees, buy & pay for insurance, pay for airline tickets and other goods and services.

Launched in Uganda 13 years ago, MTN MoMo is a fast, simple, convenient, secure, and affordable way of transferring money, making payments, and performing other transactions using a mobile phone.

This is the 4th edition of the MoMoNyabo promotions that date back to 2018. Thousands of lives have been transformed by the prizes they have won over the years. The promotion did not happen last year as the country, like the rest of the world was in the thick of the Covid-19 pandemic. However, with the reopening of the economy, this year’s MoMoNyabo Waaka promises to be yet another exciting edition with over 20,000 customers and agents set to win cars and cash prizes.

The draws will be conducted live on NBS and Bukedde TV every Thursday at 8.30 pm on NBS TV and Bukedde TV, with daily updates at the same time. The exciting shows will be presented by renowned entertainer, Richard Tuwangye alongside the vivacious Zahara Toto who is no stranger on the MoMoNyabo set.

MTN MoMo customers are urged to stay vigilant and to keep their PINs safe to avoid falling prey to fraudsters. MTN MoMo Nyabo Waaka promotion-related information will be dispatched through mainstream media, the MTN website and social media handles including

www.youtube.com/mtnug and www.twitter.com/mtnug . Customers are advised to beware of conmen and stay on alert. All the Winners shall be contacted only by 0312120000.

JUMO, a technology company building next-generation financial services for emerging markets, has partnered with MTN Mobile Money Uganda Limited to launch MoSente, a new credit service that will afford the people of Uganda more choice when it comes to mobile lending services.

MoSente is a convenient way for MTN customers to access credit facilities. Customers can borrow from UGX 10 000 at a variable term that fits their personal circumstances or earning cycles. MoSente is easily accessible, in real-time, and available to registered MTN subscribers and mobile money users when they dial *165*5*5# and follow the prompts.

MTN currently represents more than half (53%) of all mobile subscribers in the country, which means 15 million people, roughly a third of Uganda’s population, will have the opportunity to access tailored lending products to suit their business and living requirements. According to Financial Sector Deepening Uganda (FSDU), 22% of Ugandans are financially excluded and 56% use informal financial services. Financial inclusion is significantly skewed towards adults in urban areas (86%), making access to mobile banking anywhere, anytime a significant milestone.

“In a market where large segments of the population are still unbanked, in large part due to lack of access to easy and convenient credit, our partnership with JUMO is an important milestone for advancing financial inclusion for the people of Uganda,” says Richard Yego, Managing Director, MTN Mobile Money Uganda.

JUMO’s Africa CEO, Buhle Goslar, said: “Our work with MTN is focused on supporting entrepreneurs who need simple, quick access to working capital to grow their businesses. We offer them the opportunity to increase their access to credit in the long-term, through ongoing responsible loan management.”

Both MTN Mobile Money Uganda and JUMO are familiar with the financial needs of the Ugandan market. MTN has operated a similar credit service called MoKash on their Mobile Financial Services Platform since 2017. JUMO has operated a similar mobile lending product delivered in partnership with other mobile network providers for the last five years.

JUMO is currently the underwriter and capital provider for both MoSente and WeWole. The company has developed a large pool of capital to reach new customers and serve digital financial products to the financially excluded market segments.

“Partnerships between financial technology companies like JUMO and mobile money providers are essential to creating more opportunities for the people of Uganda to borrow and save conveniently using their mobile phones,” says Wilfred Wabwire, Country Manager for JUMO Uganda.

JUMO’s intelligent banking technology reduces the unit economics on the delivery and administration of financial products so that customers can access high-value products at low prices and partners such as telcos, impact investors and banks can reach new markets. The launch of MoSente in Uganda forms part of JUMO’s long-term growth plan for Africa. The company is launching new products and expanding into new markets, such as Nigeria and Cameroon, post their fundraise of $120 million in 2021.

Facts about MoSente

| Product description | MoSente – micro loan on your MTN Mobile Money |

| Multiple loans | You can either take a Mokash or MoSente loan not both, at the same time. |

| Customer journey | Dial *165*5*5# and Select option 1 “Accept”, to sign up for the service |

| Charging | MoSente offers;

|

| Nature of line of credit | This money is loaded on the customer wallet and the customer chooses to do whatever they want to use if for. |

| Payment method | Customer pays back at will as long as they have not exceeded their payment period. After loan period is done, auto-recovery from the customer’s wallet will be applied. |

| Credit Eligibility | The credit eligibility of customers may vary based on their Credit worthiness which can change time to time based on their usage of MTN Services (Voice, Data, MoMo), their tenure and their repayment behaviour of similar services subscribed to earlier. |

Following the enactment of the National Payment Systems (NPS) Act, 2020, MTN Uganda’s telco and fintech business was separated leading to the creation and licensing of MTN Mobile Money Uganda Limited in 2021. We caught up with the newly appointed Managing Director of MTN Mobile Money Uganda Limited, Mr Richard Yego, for his initial interview with the media since his appointment, during which he discussed the company’s focus for the year and shared insights on the mobile money industry.

- Congratulations upon the appointment to Managing Director, MTN Mobile Money Uganda. How would you describe your first few months at the job?

It has been an interesting 2 months for me. With the support of the team at MTN, I familiarized myself with the new role; sitting at the helm of a very economically significant company. During this period, we have been focused on the completion of the separation of the Telco and Finco entities which included building a team of personnel with the right skill-set, across the various departments whose collective strengths and efforts will steer the company in the right direction.

- It is close to a year since the mobile money business was separated from the telco core business, how has the adjustment been for MoMo?

The separation of Telco and Fintech businesses took place in May last year with the guidance of Bank of Uganda (BOU) which culminated into the creation and licensing of MTN Mobile Money Uganda Limited. At MTN, we welcomed this move because we believe in the power of regulation in creating a conducive business environment for not only us the operators, but also our customers. Following implementation of the law about 10 months back, we are now being directly regulated by BOU which has greatly improved the rate at which we innovate. Owing to direct engagement with BOU for approvals of product and services, we are now able to achieve faster speed to market of new services, to the benefit of our customers.

- Following the enactment of the National Payment Systems (NPS) Act, we have seen a proliferation in the number of fintechs licensed to undertake mobile money business, are you concerned this will impact MTN MoMo?

The enactment of the National Payment Systems (NPS) Act, 2020 and the implementation of the accompanying NPS Regulations, 2021 therein have enabled the entry of new market players in the Fintech industry. This brings competition in the Financial Services space that spurs innovation and improvement of quality of services in the sector which is a welcome move. As MTN, we remain focused on consolidating our market leadership by leveraging our value proposition to our customers and stakeholders through ensuring that we deliver more value and quality because at the heart of our ambition is to lead the drive for digital and financial inclusion in Africa.

- After nearly two years of lockdown, how is mobile money fairing today in comparison to 2020 and 2021?

With the full reopening of the economy earlier this year, a sizeable part of the population has returned to work, and we have seen an increase in daily transactions. The results for the first quarter will be shared by the end of this month to give a full picture. We are optimistic about the future and remain focused to delivering relevant services and shared value to all our esteemed customers.

- As the new MD, what are your investment plans, focus or Strategy for MTN MoMo this year?

Our objective is to leave no one behind in our quest to promote financial inclusion in Uganda and achieve a key pillar in our ambition 2025 strategy rooted on sharing economic value with our customers.

Our major area of investment for this year is hinged on enriching our MoMo ecosystem and platform capabilities. We are focused on scaling the adoption of our Banktech products like Loans & Savings, Payments, and e-Commerce.

We remain determined to attain a cashless economy, something that has been accelerated by covid and therefore we will continue to entrench MoMo pay across the country through strategic partnership engagements.

- In your opinion, what do you think will drive mobile money growth this year?

I believe mobile money will grow mainly on the account of the full reopening of the economy. We anticipate an increase in mobile money activity owing to the fact that businesses are all fully reopened meaning more jobs are going to be created thus attracting income, the night life is back in action, travelling across or in and out of the country is unlimited. We believe this will greatly impact on the volume and value of income transacted via the service. We expect increased activity across all the MTN MoMo products.

- Mobile money fraud remains a concern in the ecosystem. Are there any plans to tame this?

In a bid to curb mobile money fraud, we have embarked on sensitization initiatives in the market. Through our newly formed National Payment Systems (NPS) Providers Association, we are going to launch a major sustained customer sensitization campaign at an industry level later this month. This initiative is aimed at driving customer awareness of the importance of protecting their Personal Identification Numbers (PINs) and One Time Passwords (OTPs). We believe this consistent awareness campaign will empower customers with information to safeguard their accounts. We do hereby assure the public that the MTN MoMo platform is safe and secure. We also urge our customers to always keep their PINs and OTPs secret and not share them with anyone.

- What is the future outlook of MTN MoMo?

Looking into the future, MTN MoMo should be a way of life. We want the MTN MoMo wallet to be part of everyone’s day-to-day life. The goal is to enable our customers to pay for all goods and services using MTN MoMo. We are positioning MTN MoMo as a financial solution aimed at driving digital and financial inclusion and boosting economic growth in the country as highlighted in our ambition 2025 strategy.

MTN Mobile Money Uganda Limited, a 100% duly owned subsidiary of MTN Uganda Limited, is pleased to announce the appointment of Richard Yego as its Managing Director.

“We are delighted that Richard Yego joins the MTN family as the Managing Director for MTN Mobile Money Uganda. He brings with him a wealth of experience attained from his journey through the banking and digital financial services sector, which will be pivotal to the realization of the company’s strategy and vision of creating a modern connected world,” Wim Vanhelleputte, a member of the board of directors of MTN Mobile Money Uganda and the CEO of MTN Uganda, said.

Prior to his appointment at MTN, Richard served as the CEO of the Agent Banking Company of Uganda where he was responsible for the overall operations of the Joint Venture Entity of Uganda Bankers’ Association and Eclectics International.

In the same role, he supported the implementation and roll-out of an inter-operable Shared agent banking technology and agent network infrastructure across Uganda, a move which fast-tracked financial inclusion by ushering convenience in the uptake of digital financial Services among the banked, under-served and unbanked population.

Richard Yego, Managing Director MTN Mobile Money Uganda Limited.

With over 15 years of experience in the financial sector, occupying several senior roles, Richard boasts of a stellar track record in successfully steering disruption in the digital financial services space.

At MTN, Richard will deploy strategy to shape and direct the Mobile Financial Services business. He will provide strategic leadership in the use of technology innovatively to improve and automate the delivery of financial services. He will also harness strategic relationships to develop the financial and mobile money ecosystem.

Richard holds a bachelor’s degree in Economics from Makerere University bolstered by several other qualifications and certifications in Digital Financial services. His appointment takes effect on 1st February 2022, subject to regulatory approval.

Yego’s appointment comes after the formulation of MTN Mobile Money Uganda ltd. in accordance with the National Payments Systems Act 2020 which prescribed the separation of the financial services from the core telecom business.