Customer

Register on MoMo

Using MTN Mobile Money

MTN Mobile Money offers a wide range of functionality, from sending and receiving money to paying for goods and services. But in order to take advantage of these features, you need to first register. Download this document for Mobile Money Consumer Terms and Conditions.

To register for Mobile Money, follow any one of these two easy processes:

In store

- Visit your nearest authorized Mobile Money agent.

- Upgrade your SIM to a Mobile Money-enabled card using a SIM swap.

- The agent will take you through the registration process.

- Fill out the physical registration form and bring the original document (plus a copy of) any of the following: valid passport; driver’s license; company ID; government ID; tax certificate; LC certificate; or voter’s card

- Complete your registration by opening an account with a balance of UGX 0

At home

- Download the registration form

- Fill it out

- Drop it off at the nearest MTN service point with a copy of your ID and passport photograph.

Or

Email a scanned copy of the form together with your ID and passport photograph to register@mtn.co.ug. Registration is free of charge.

To learn more about registering for Mobile Money, call us on 122 or 100. You can also log your request at www.twitter.com/mtnug or www.facebook.com/mtnug

Send & Receive Money

Simply send money from your Mobile Money account to another Mobile Money account, or send money from your Mobile Money account to a Non-Mobile Money registered number (on MTN or another network), using a secret code which the receiver will present to a Mobile Money Agent who will cash them.

- Dial *165#

- Select Send Money

- Choose to send Money to a Mobile User (someone with a mobile phone) OR a Non-Mobile user (someone without a mobile phone)

If Sending to a Mobile User:

Step 4: Enter Recipient’s Phone Number

Step 5: Enter Amount

Step 6: Enter Reason for sending

Step 7: Confirm Enter PIN Code

Step 8: You will receive a confirmation message

If Sending to a Non-Mobile User:

Step 4: Enter Amount

Step 5: Enter Reason for sending

Step 6: Create a four digit (4) secret code.

Step 7: You will receive a confirmation message

Step 8: Send the secret code generated

Buy With MTN MoMo

Load airtime on your phone or send airtime to another number direct from your Mobile Money account balance.

How to

Step 1: Dial *165#

Step 2: Select Buy Airtime

Step 3: Enter Amount in UShs

Step 4: Enter Mobile number

Step 5: To Confirm Enter MM PIN Code

Step 6: You will receive a confirmation message

Cost

Buying Airtime Using Mobile Money is FREE of charge.

Payments

Goods and services

Paying for goods and services is easy, safe and convenient with MTN Mobile Money. Pay for any of the following services; Utilities, Pay TV, School Fees, Fees and Taxes, Lotto and many others.

Dial *165*4# to get started.

Pay KCCA fees using MTN Mobile Money

Kampala Capital City Authority (KCCA) is the governing body of the capital city and administers the city on behalf of the central government.

The authority is responsible for the assessment, collection and accountability of revenues collected from revenue sources such as trading license, fees, ground rent, property tax, penalties/fines, rentals, hotel tax and other fees collected from various City operators.

MTN customers can pay their KCCA licenses, fees and taxes using MTN Mobile Money. All you have to do is dial *165#, select ‘Fees and Taxes’ and then choose KCCA.

Thereafter, you will have to enter the payment reference number, the amount and then confirm payment by entering your MTN Mobile Money PIN.

Pay URA taxes and fees using MTN Mobile Money

Uganda Revenue Authority (URA) has partnered with MTN to facilitate payment of taxes using MTN Mobile Money.

MTN customers can pay their URA fees and taxes using MTN Mobile Money by dialling *165#, selecting ‘Fees and Taxes’ and then choosing URA.

There are two payment options

- With PRN (Payment Reference Number)

- Without PRN

| Amount (in UShs) | Rates (in UShs) |

| 500 – 2 500 | 190 |

| 2 501 – 5 000 | 330 |

| 5 001 – 15 000 | 1 000 |

| 15 001 – 30 000 | 1 600 |

| 30 001 – 45 000 | 2 000 |

| 45 001 – 60 000 | 2 650 |

| 60 001 – 125 000 | 3 500 |

| 125 001 – 250 000 | 3 950 |

| 250 001 – 500 000 | 5 050 |

| 500 001 – 1 000 000 | 10 700 |

| 1 000 001 – 2 000 000 | 20 500 |

| 2 000 001 – 4 000 000 | 40 000 |

Amount (in UShs)

500 – 2 500

- Rates (in UShs)

190

Amount (in UShs)

2 501 – 5 000

- Rates (in UShs)

330

Amount (in UShs)

5 001 – 15 000

- Rates (in UShs)

1 000

Amount (in UShs)

15 001 – 30 000

- Rates (in UShs)

1 600

Amount (in UShs)

30 001 – 45 000

- Rates (in UShs)

2 000

Amount (in UShs)

45 001 – 60 000

- Rates (in UShs)

2 650

Amount (in UShs)

60 001 – 125 000

- Rates (in UShs)

3 500

Amount (in UShs)

250 001 – 500 000

- Rates (in UShs)

5 050

Amount (in UShs)

500 001 – 1 000 000

- Rates (in UShs)

10 700

Amount (in UShs)

1 000 001 – 2 000 000

- Rates (in UShs)

20 500

Amount (in UShs)

2 000 001 – 4 000 000

- Rates (in UShs)

40 000

Donations

With MTN Mobile Money you can now do your part to give back to the community with MTN’s quick and convenient Mobile Money Donations service.

- Step 1: Dial *165#

- Step 2: Select ‘Donations’

- Step 3: Select the option you would like to make a donation to

- Step 4: Enter your payment reference

- Step 5: Follow prompts

- Step 6: Enter the amount

- Step 7: Enter your Mobile Money PIN

- Step 8: You will receive a notification

See Mobile Money Tariffs for rates.

Pay School Fees

Paying for school fees is easy, safe, and convenient with MTN Mobile Money.

Benefits of using MTN Mobile Money;

- This is a simple process and is extremely time-saving.

- The service is available on your phone so you can pay fees at any time from anywhere.

- This is an affordable service.

Note: Student ID is provided by the school.

For “Primary – University and Flexi Pay”

Step 1: Dial *165*4# and Choose option 3 >School Fees or click *165*4*3#

Step 2: Choose Primary- University if the school has registered with the platform or Flexi Pay if you use Stanbic Bank. Make sure your school accepts payment from the option you’re going to select to avoid making the payment twice.

Step 3: Choose Pay Fees

Step 4: Enter the school registration code provided by the school.

Step 5: It will show you the School Name

Step 6: Enter Student’s name as a reason to be uniquely identified.

Step 7: Enter Amount

step 8: Confirm payment after which the message can be presented to the school for confirmation.

For School Pay, Bridge international and Magezi harvest

Step 1: Dial *165*4# and Choose option 3 >School Fees or click *165*4*3#

Step 2: Select Channel to use i.e School Pay, Bridge international, or Magezi harvest

Step 3: Choose Pay Fees

Step 4: Enter the student number, provided by the school.

Step 5: It will show you the student name and class plus the outstanding balance, Enter the amount you want to pay and follow the remaining prompts

For MyMTN App

Step 1:Log into the MTN MoMo app

Step 2:Select Pay Bill

Step 3Select School Fees

Step 4:Select preferred option (Primary – Secondary, FlexiPay, School Pay)

Step 5:Enter Student Id/ School code and amount

Step 6:Confirm Payment

You will get a confirmation SMS with details of payment after which you will present to the school for reconciliation.

Pay With MTN MoMoPay

This is a service that enables merchants receive payment for goods and services using MTN Mobile Money. It is accessible using *165*3# for both customers and merchants. With MoMoPay, merchants can sell airtime and earn commission, pay suppliers, pay salaries as well as transfer money to the bank.

Getting Started

Would you like to sign up your business to MTN MoMoPay? Simply send an email to MoMoPayRegistration.Ug@mtn.com with the following information and we will get in touch with you.

- Your name

- Name of your business

- Contact number

- Location

or email customerservice.ug@mtn.com or call 100

Benefits of MoMoPay

- Reduces risk of carrying cash.

- No issues of small change amounts.

- Additional revenue for Merchants who can earn commission by selling airtime or making payments for customers.

- Customers and merchants can deposit and withdraw funds from their bank accounts.

Rates

- Customers use MoMoPay at a small fee dependent on the sector.

- Formal merchants and informal merchants will be charged a percentage of the payment received based on the sector.

Download MoMo Terms and Conditions

MTN MoMo Remittances

Receive funds and transfer funds out of Uganda with MTN MoMo RemittanceMTN MoMo Remittance is a service that enables all registered MTN MoMo customers to send and receive Globally. It is the fastest and most cost-effective way for our customers to receive funds from abroad or send money across Uganda borders.

- The money you receive from outside Uganda is credited to your MoMo account in Ugandan shillings (UGX).

- The money you send to other countries is received in the currency of that respective country.

- The currency conversions in both scenarios are done automatically for the convenience of our customers.

All these transactions are instant.

Sending money from Uganda to other countries through MTN MoMo

This can be done right from your phone;

- Dial *165# and select Send Money, then choose between sending to Africa or others outside the continent

- Log onto the MTN MoMo App , select– Send Money then choose between sending to Africa or others outside the continent

How to send money from Uganda to other countries

Step 1: Dial *165*1*2# to send to Africa.

OR *165*1*3# to send to the Rest of the World.

Step 2: Select recipient Country*

Step 3: Enter the receiver number and amount in UGX

Step 4 Confirm sending details, enter your PIN and send.

Which countries can our customers send money to?

Today, our customers can send money to over 20 countries in Africa and the Rest of the World to these countries.

Countries in Africa:

- Kenya

- Rwanda

- Tanzania

- Ethiopia

- Burundi

- Zimbabwe

- Mozambique

- Cote D’Ivore

- Congo DRC

- Congo Brazzaville

- South Africa

- Nigeria

- South Sudan

- Somalia

- Malawi

- Zambia

- Botswana

Rest of the World:

- India

- China

- Turkey

- Japan

- Mexico

- Canada

- Thailand

- Philippines

Receiving money in Uganda from abroad

MTN MoMo customers instantly receive money directly into their MTN MoMo account in Uganda Shillings at FREE OF CHARGE.

Which countries can an MTN MoMo customer receive funds from?

Customers can receive money from over 70 countries around the world, including:

United Kingdom (UK), United States of America (USA), United Arab Emirates (UAE), Asia, and South America, for example, Dubai, Bahrain, Saudi Arabia, Germany, Canada, Qatar, South Africa, Canada, Germany, Sweden, Norway, Bahrain and many more

How to send money from abroad to Uganda?

MTN MoMo has partnered with over 100 Money Transfer agencies across the World to enable sending money to MTN MoMo. These partners, among others, include:

- World Remit

- Safaricom Mpesa

- MFS Africa

- Thunes

- TerraPay

- Western Union

- MoneyGram

- Sendwave

- Transfer Galaxy

- Transfast

- Paysend

- Mgurush

- The Boss Revolution

- Unimoni

- Lulu Exchange

- Tigo

- MTN Rwanda

- MTN Ghana

The rates:

Receiving from abroad to Uganda- FREE OF CHARGE.

Sending money from UGANDA to other countries.

| Amount (UGX) | Sending charge |

| 1-5,000 | 100 |

| 5,0001-60,000 | 500 |

| 60,0001-5,000,000 | 1,000 |

Amount (UGX)

1-5,000

- Sending charge

100

Amount (UGX)

5,0001-60,000

- Sending charge

500

Amount (UGX)

60,0001-5,000,000

- Sending charge

1,000

Benefits of Sending or Receiving money from abroad using MTN MoMo:

- Convenience for both senders and recipients since everything happens on the phone anytime and anywhere.

- Affordable and cheaper than going to an International Money Transfer branch to send or receive money.

- Time-saving – transact anytime from the comfort of your home, office, or taxi.

- Wide coverage where you can send to mobile money users and bank accounts in another country (see listings below).

- You can send or receive up to UGX 5 million per transaction and UGX 20 million per day.

You can send money for school fees/tuition, Investment, trade, medical bills, family upkeep, savings, and much more.

Financial Services

Get MoMo from any bank

You can withdraw money from your bank account to your MTN Mobile Money account.

Dial *165*6# or use the MoMo App to get mobile money to any bank account.

Step 1: Dial *165*6#

Step 2: Select ‘Get Money from Bank’

Step 3: Select ‘Bank’

Step 4: Enter amount (UShs)

Step 5: Enter your MoMo PIN

Step 6: You will receive a confirmation message

Cost

See Mobile Money Tariffs for rates.

Send MoMo to any bank.

You can transfer money from your MTN MoMo account to any bank account.

Dial *165*6# or use the MoMo App to send mobile money to any bank account.

How to:

Step 1: Dial *165*6#

Step 2: Select ‘Send to Bank Account’

Step 3: Select ‘Bank’

Step 4: Select ‘ ‘Bank account’

Step 4: Enter Amount (UShs)

Step 5: Enter your MTN MoMo PIN

Step 6: You will receive a confirmation message

Cost:

See Mobile Money Tariffs for rates.

Savings and Loans

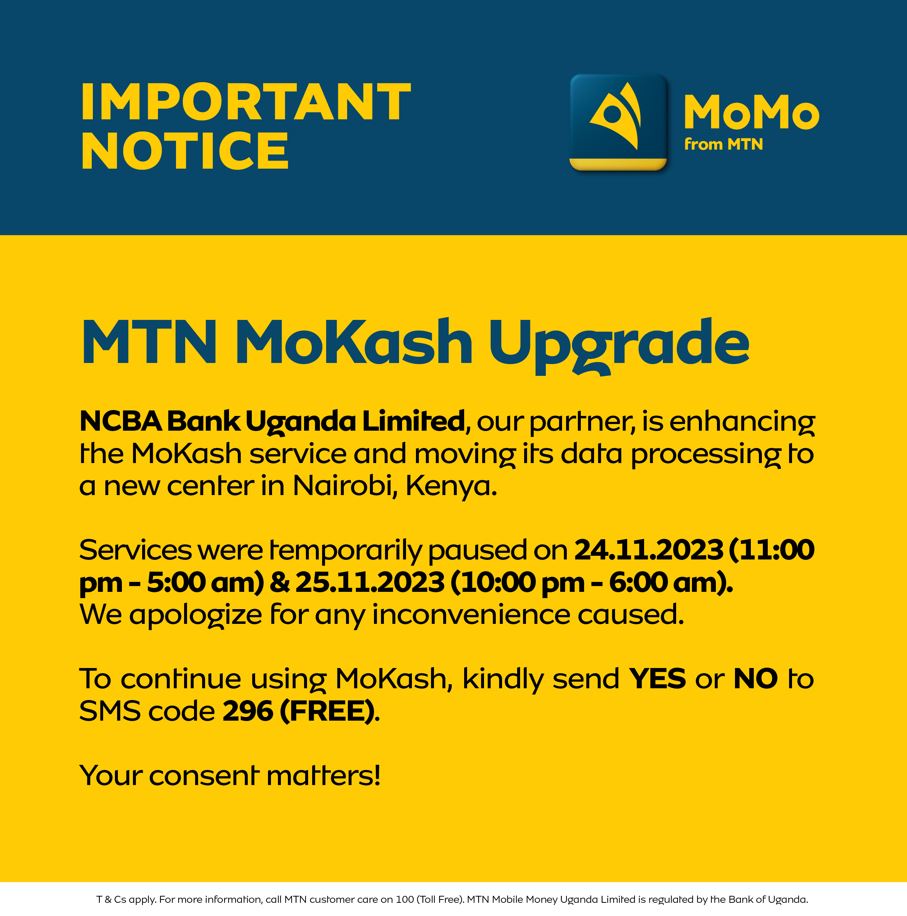

MoKash is a service that provides customers the ability to save and borrow using their phones. Customers can save while earning an interest or take out short term loans at a reasonable fee.

The customer does not have to visit any bank to fill out forms.

To activate a customer should dial *165*5# and enter their MTN Mobile Money PIN.

Getting started.

- To use the service you have to be an MTN customer and active on MTN Mobile Money.

- Dial *165*5# to get started.

- You will be prompted to enter your MTN Mobile Money PIN to activate your MoKash account.

Cost

- Activation of a MoKash account is

- Any transactions between MoKash and Mobile Money are free. Ie Savings, Auto savings, Loans, Loan payment, Account balance check.

Interest Rates – Savings.

You can save a minimum of UGX 50 up to any amount depending on KYC level

| Amount | Interest |

| 1 – 300,000 | 2% |

| 300,001 – 800,000 | 3% |

| 800,001 – 1,600,000 | 4% |

| > 1,600,000 | 5% |

Amount

1 – 300,000

- Interest

2%

Amount

300,001 – 800,000

- Interest

3%

Amount

800,001 – 1,600,000

- Interest

4%

Amount

> 1,600,000

- Interest

5%

Interest Rates – Loans

You can borrow between UGX 3,000 to UGX 1,000,000 depending on your loan limit at an interest rate of 9%.

You can access all the frequently asked questions here.

You can access all the terms and conditions here.

NOTE: In compliance with Section 19 of the Data Privacy & protection Act, the data processing is conducted through NCBA Bank Uganda Limited.

clinicPesa

clinicPesa is a healthcare financing solution that empowers you to save, borrow and pay for healthcare or purchase drugs/medicine in time of need at any of our partnering healthcare facilities.

clinicPesa also has a maternal health service called clinicPesa MaMa’s.

clinicPesa MaMa’s is a behaviorally driven mobile money maternal health savings account platform that empowers expectant women and couples to access timely savings towards maternity care, purchase of birth preparedness kits (MaMa Kits), upkeep, as well as afford transportation to the healthcare center, hence empowering them to afford safe child delivery.

Our target beneficiaries

Individual users

- Individuals who are 18 years old and above, owning a registered MTN sim card and are registered on MTN mobile money.

- Expectant women (ages 18-49), women of reproductive age (18-49) who are planning to become pregnant and men who are pregnant or planning to become pregnant partners (ages 18-49).

Healthcare Facilities

- Formal and informal healthcare facilities that include hospitals, medical centers, clinics, pharmacies and drug shops that are licensed and regulated by the Uganda Medical Practitioners Council and National Drug Authority established under the relevant national laws under the ministry of health.

To create an individual Account;

- Dial *165*5#, select clinicPesa and enter your Mobile Money PIN to accept the terms and conditions. This automatically activates your clinicPesa Account.

Alternatively;

- Download the clinicPesa App on google play store or visit the web, enter your phone number.

- Accept terms and conditions on your MTN handset with your MTN MoMo PIN.

- Create a 5-digit clinicPesa PIN you would love to use.

To create a facility Account;

- Visit https://register.clinicpesa.com, request to open an account and track your facility account creation process.

NOTE: Always keep your clinicPesa PIN and MoMo PIN a secret.

Cost

- Activation of a clinicPesa account is completely free of charge.

- Any transaction between clinicPesa and Mobile Money is free of charge. I.e. Savings, Auto savings, Loan Repayment, Account balance check.

- Payment of a medical bill to our partnering healthcare facilities is completely free of charge.

- A transactional fee of 1% is charged to our partnering health facilities on withdrawal.

Savings

- A user can save any amount from as low as UGX 500 cumulatively over time.

- A user can set AutoSave (set standing order) to allow clinicPesa system save on their behalf.

- A user earns Interest of up-to 5% annually on their savings.

- A user will take at-least 12 months to qualify to withdraw savings plus interest accumulated free of charge. Between 6 to 11 months a user qualifies to withdraw funds at transaction fees equivalent to the interest earned over time.

Loans

- This is a loan top up made to clear your medical bills at a very affordable interest rate of 7% and it is paid directly into the clinicPesa partner healthcare facility of your choice.

- A user can take a loan between UGX 3,000 up to UGX 3,000,000.

- The user does not incur recurring interest on medical loan but a penalty of 7% is applied for late loan repayment.

- The clinicPesa loan duration is 30 days. After 30 days a penalty is applied, attempts for loan recovery are applied within your additional 30 days to clear the loan.

FAQs

You can access all the frequently asked questions here

Terms and conditions

You can access the Terms and conditions here